Liabilities That No Longer Fit Your 2026 Plan

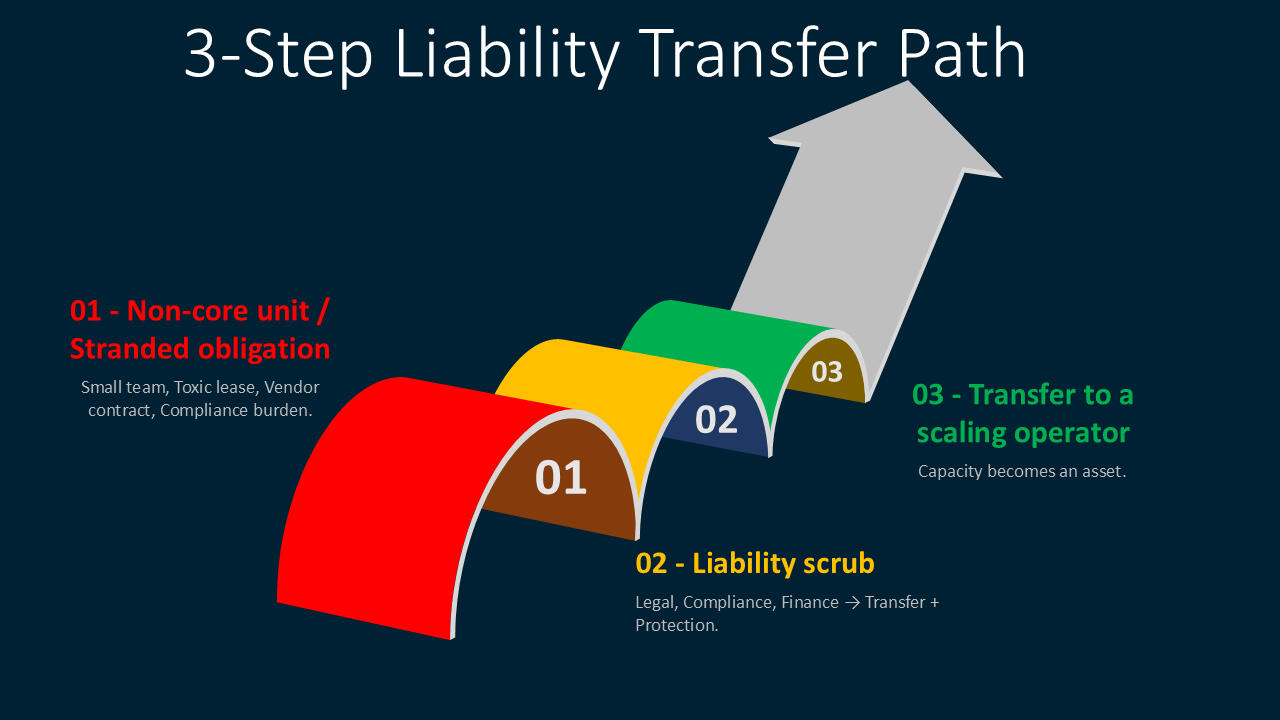

If you have an oversupply of liabilities like non‑core units, stranded obligations, or compliance burdens that no longer fit your 2026 plan, we can absorb it with Zero CapEx (Nothing Out of Pocket) and no operational disruption.

Our team handles the transfer, protection, and regulatory scrub, so you can exit cleanly and stabilize quickly.

SynergyLeap

Who We Support

Providing structural clarity for institutions navigating non-traditional risk and stranded obligations.

• Corporations: Managing legacy, non-core regulatory or financial burdens through strategic liability transfer.

• Infrastructure & Telecom: Resolving stranded maintenance and transition obligations within multi-party environments.

• Municipal Agencies: Ensuring service continuity and digital expansion without incurring new fiscal exposure.

• Private Equity: De-risking entry into operationally dense environments with pre-vetted compliance frameworks.

SynergyLeap

Execution

Bridging the gap between institutional risk and operational resolution. • Execution-First Mindset: We focus exclusively on the specific levers that move a stalled transaction from "impasse" to "closed." • Institutional Neutrality: Operating as independent architects, we maintain loyalty to the structure’s integrity rather than a single firm's bureaucracy. • Pre-Vetted Compliance: Leveraging a proprietary framework to pre-align transitions with Big Four audit and regulatory standards. • Confidential Discipline: Managing sensitive asset transfers with the discretion required for multi-party stakeholder protection.

SynergyLeap

ENGAGEMENT

By Invitation Only

© 2026 SYNERGYLEAP LLC | PRIVATE & CONFIDENTIAL